How to save money in preparation for college

Author: Marcela De Vivo

Published: Sep 9 2013

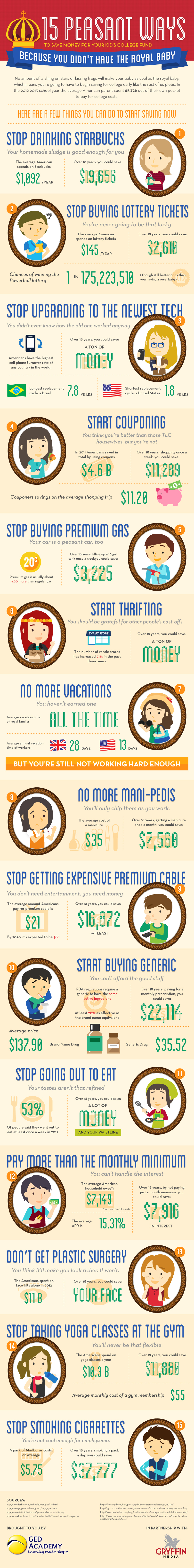

Planning for college and stumped by how to cover the ever rising tuition costs (not to mention the cost of dorms, food, textbooks, and other living and entertainment costs)? In the last 60 years alone, the cost of higher education has risen nearly 500%. So how are you going to pay for your (or your kid’s) four years at college? Some students and their families end up relying on student loans and other forms of financial assistance—but that can lead to massive debt for many in the long run. However, if you start saving now, you might be able to avoid the crushing student loan debt that accompanies so many college experiences.

While cutting costs now to save money for education doesn’t seem like a lot of fun, a few small changes is not a big sacrifice. Consider it an investment in your future! The thousands of dollars that you need won’t be saved overnight, but cutting out a few dinners and manicures here and there, and skipping Starbucks for home brew can add up to a full tuition (especially if you put that money to work for you by finding an account that offers a good interest rate). This infographic by GED Academy shows you how much you’d save over 18 years with just a few small changes to your current lifestyle. Make a few small changes and paying for college education will no longer be a big problem.

This article is published on the basis that the supplied content is the original work of the author / provider. If you feel that copyright has been infringed, please contact the site administrator.

B-0