The rising costs of tuition & student loan debt

Author: Marcela De Vivo

Published: Aug 12 2013

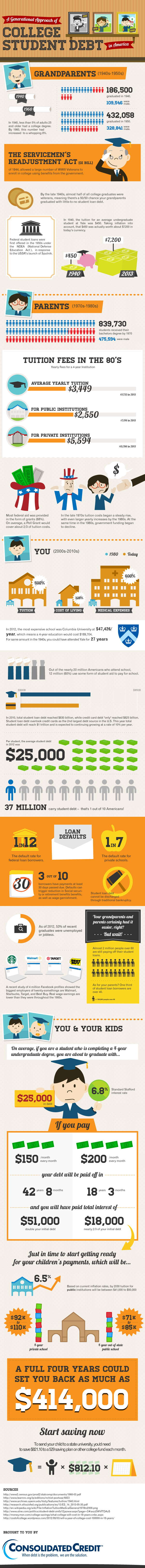

If you’re planning on going to college, then you already know that finding ways to pay for it can be a challenge. Even if you’re working part time jobs, saving money, and playing the lottery, coming up with enough money to secure an undergraduate degree is infinitely more difficult today than it was 60 years ago. In fact, the cost of college education has increased by 500 percent since your grandparents went to school. Most people will have to rely on financial assistance, like grants and loans to get through four years of undergrad. Unfortunately, these loans can take years to pay off, creating on on-going burden that wreaks havoc in life after college. What used to be a path to a secure financial future now is the cause of many headaches. In fact, one in 12 federal student loan borrowers end up in default—and are unable to declare bankruptcy.

Educate yourself on the actual cost of student loans and rising tuition costs with this handy infographic by ConsolidatedCredit. It gives you a clear idea of just how much debt you could be facing, and learn more about the past, current, and future cost of education.

This article is published on the basis that the supplied content is the original work of the author / provider. If you feel that copyright has been infringed, please contact the site administrator.

B-0